Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

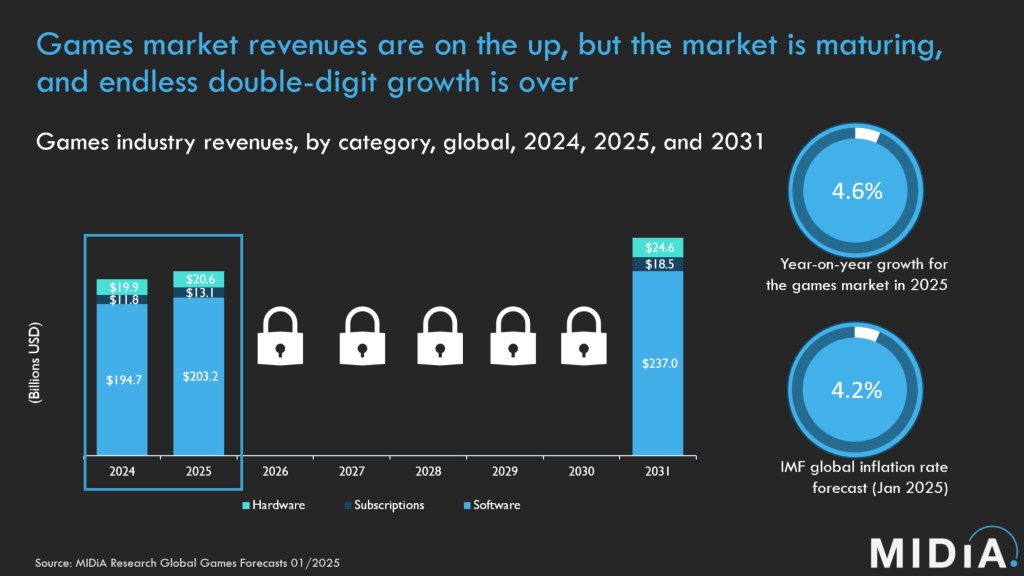

The research company Midia recently introduced its Global Games forecast report for 2025 to 2031, in which certain trends in the game industry predict. And in this report, the forecast predicts that the day of the high growth of the game industry may be behind it. In particular, it predicts that double-digit growth is probably not continued and that publishers should report their expectations if they do not want to have a disappointment about their lack of profits-and that “and that”Survival up to ’25Is not enough.

The report forecast software income of 203.2 billion US dollars in 2025 and 237.0 billion US dollars in 2031, which makes playing in accordance with the predicted inflation rate of the international monetary fund of 4% and essentially the growth for the year . It is also predicted that the start of the Switch 2 will increase the hardware income in 2025 by 8.4% to 20.6 billion US dollars after the severe decline of 2024 2024; And that the global number of players will grow, the average turnover per paying user drops thanks to growing numbers in emerging countries.

The core of the report is an contrast to more sunny predictions of an industry-wide return to the Pandemie era of the two-digit growth is “over”, it says bluntly. While it recognizes that playing gives a juice from the introduction of GTA VI and the Switch 2, it is found that this will not be a good thing for no one besides the companies that create these products.

Rhys Elliott, Midias Games Analyst, said in a statement: “Do not make a mistake: GTA and the Switch 2 and other premium publications-become contributing). But Nintendo and Take-Two will be the big winners here. GTA 6 will attract all attention and have a negative impact on the games of other developers. “

Midia’s report also notes that growth vectors such as live service games and subscription services will not be the money earners who believed many, and this is reflected in the earlier case. Several live service games were closed or will be closed shortly due to a lack of user interest and income that flows back to the companies. Gaming subscriptions such as PlayStation Plus and Xbox Game Pass may also be able to record a significant slowdown in growth, since the attention of users is so divided. The report states: “The live service gold rush already had its winners.”

Elliott said in a follow -up interview with Gamesbeat: “Many managers thought that some consulting companies and leading games were analytical companies to believe that two -digit growth would continue (after pandemic) and to make risky projects and strategies greenish. In the end, many of the resulting movements did not assume – or are not. And some were canceled after years of development – and a week after the start in Concord’s case. The game market has reached its ripening phase and has been the case for some time. “

In short, there is simply not enough attention to the players to go for all of these projects, which means that game publishers have to find other ways to support themselves. The Switch 2, which could possibly support any kind of Mobile’s game to the PC (if the rumors about the new mouse-like functionality are true), the publishers will probably offer a way to extend the lifespan of their back catalogs. Developers can also appeal to sub -supplied markets.

And if there is an advantage for players, the game industry will probably cancel their obsession with live service titles and again the premium titles for single players return games like Black Myth Wukong and Baldur’s Gate 3. To quote Elliott: “My recommendation: Less waste, less trend hunting, more innovation and more data -binding segmentation. The market cannot cope with the same players and expect the cake grow. “