Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

(Bloomberg) – Deepseek’s breakthrough in artificial intelligence helps to drive a rotation of equity funds from India back to China.

Most read from Bloomberg

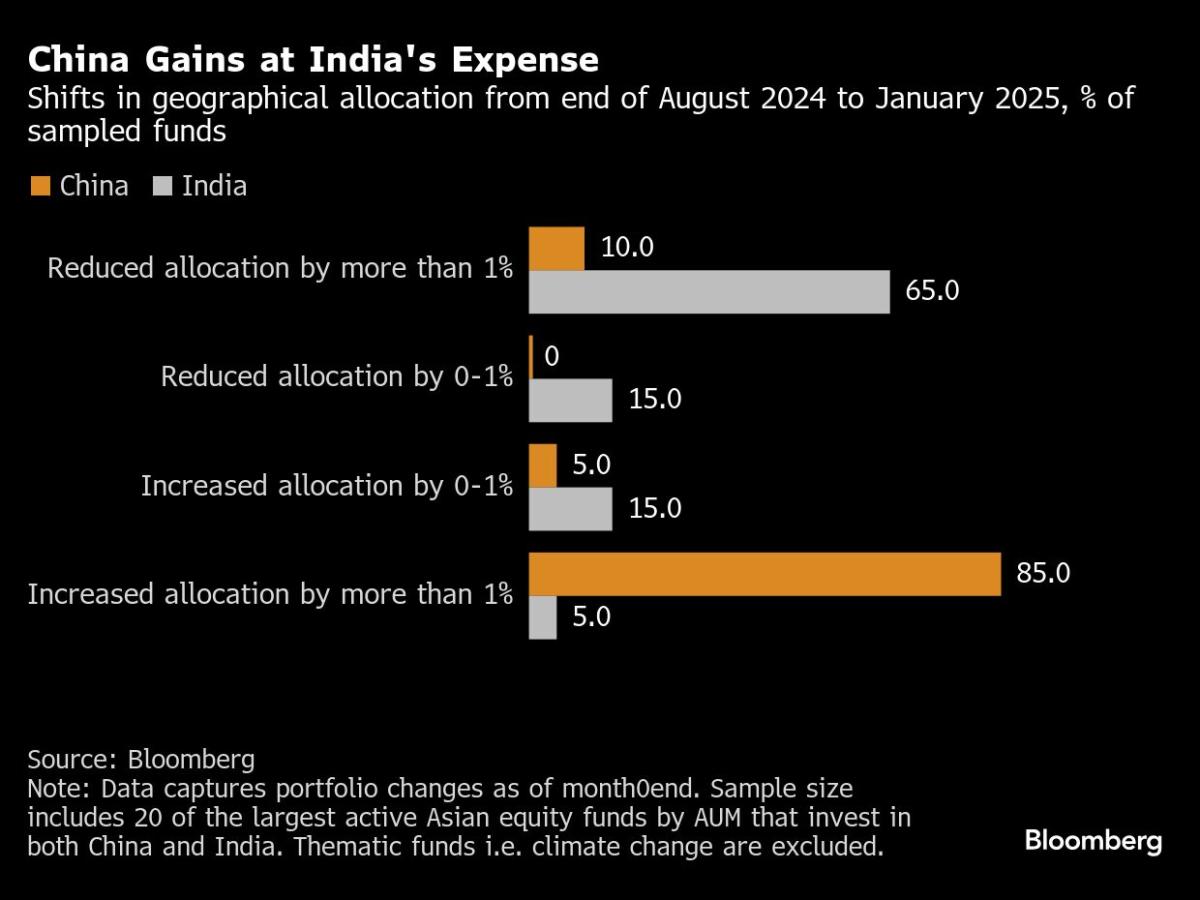

Hedge funds have been stacked into Chinese stocks at the fastest pace for months, since the Bullisum in the Deepseek-controlled technology rally contributes to the hope of more economic incentives. In contrast, India suffers from a record amplifier of cash about concerns regarding macro -aches, slowing down the company’s results and the expensive equity reviews.

China’s markets for onshore and offshore shares added more than 1.3 trillion dollars of more than 1.3 trillion US dollars last month, while the Indian market has shrunk by more than 720 billion dollars . The MSCI China index is on the right track to exceed its Indian counterpart for a month in a row, the longest such stripes in two years.

Deepseek has shown that “China actually has companies that form a significant part of the entire AI ecosystem,” said Ken Wong, a specialist for Asian stock portfolio at Eastspring Investments. His company has added Chinese Internet stocks in recent months, while he trimmed smaller Indian stocks that “had gone far beyond their evaluation volimia”.

The rotation marks an environment from the rotation to India, which can be seen in recent years and lure donations from China. This was based on the splendor from India in the infrastructure and its potential as an alternative manufacturing center to China. Domestic India was also regarded as a relative refuge in the middle of Donald Trump’s tariff plans.

China seems to have regained his earlier calling to a fundamental re -evaluation of his investments, especially in technology. After Beijing frightened investors with corporate attacks not too long ago, he could actually contribute to exceeding the new AI topic, such as the news that entrepreneurs, including the Alibaba Group Holding Ltd. to meet the country.

Deepseek-related developments are likely to help strengthen the Chinese economy and its markets and offer a longer thrust, said Vivek Dhawan, a fund manager at Candriam. “If you put all parts together, China becomes more attractive than India in the current facility for risk expectations.”

The valuation differential also contributes to China’s Allure. The MSCI China index deals with only 11 times the forward gain estimates compared to the 21 times for the MSCI India Index.