(Bloomberg) – Shares in Asia together with futures for the European and US markets after President Donald Trump tried to calm a business round table about the prospects for the economy and the steps he undertakes to increase growth.

Most read from Bloomberg

A measuring device of regional stocks that were traded in a narrow area, while the Australia Benchmark S&P/ASX 200 index hovered near a correction when Trump’s tariffs for steel and aluminum came into force without exceptions. The government bonds rose and the dollar increased to all colleagues from the 10-year-old before reporting a consumer fuel later on Wednesday.

Futures for the S&P 500 and the Nasdaq 100 won after Trump said that he did not see a US recession that Wall Street’s Jitter is playing down in his trade war. Contracts for Europe rose by up to 1%after the Ukraine had accepted a US proposal for a 30-day ceasefire with Russia.

Trump’s collective bargaining policy, geopolitical realignments about Ukraine, the sticky inflation and the unknown pace of the interest rates of the Federal Reserve have reached the markets this year, so that we have left stocks on the sidelines of a correction. The VIX knife of stock volatility has been floating almost the highest since August, while a similar measure for government bonds is at level that has not been observed since November because the market participants are nervous due to the US economic growth.

“Any relief of all the geopolitical noise is currently a good thing for the markets,” said Ken Wong, an Asian share portfolio specialist at Eastspring Investments. News about a ceasefire in Ukraine and the facilitation of tariff voltages between the USA and Canada help, he said. “Things are very different eight hours ago.”

Trump said that top executives were gathered at a meeting of the business circuit that he had priority in terms of quick permits, especially with regard to the environmental regulations, and, according to a person familiar with the meeting, soon wanted to announce a large electricity project. He also confirmed a proposal that the business taxes of a company could be reduced if he produces its products in the United States.

Goldman Sachs Group Inc.’s strategists have taken their goal for the US shares in the middle of increasing concerns about the growth of the world’s largest economy and a decline in the “great 7” shares.

Get the Daily newsletter markets to find out what moves stocks, bonds, currencies and raw materials.

Trump tried to moist the concerns of a recession in the US economy.

“I don’t see it at all. I think this country will be booming, ”he said in the White House. He added that the markets will “climb and they will go under. But you know what, we have to rebuild our country. “

In geopolitics, less than two weeks after Trump insulted Ukrainian President Volodymyr Zelenskiy in an Oval Office, the US President Russia put pressure on an armistice contract with Zelenskiys consultants.

The Agreement in Saudi Arabia received the US and Ukrainian negotiators for a 30-day conflict that began with the full invasion of Russia three years ago, and now depends on the Russian President Vladimir Putin.

Trump’s recent tariffs for steel and aluminum imports came into force on Wednesday and extended his trade wars to more of the best trading partners in the United States to revive an industrial basis that hiked to foreign competitors for decades. The President announced his plan last month to impose 25% tasks on the metals.

The European Union launched countermeasures to the new US tariffs for steel and aluminum with plans, duties for American goods worth € 26 billion (28.3 billion US dollars). The European Commission, the EU’s executive arm, said in a statement that it would progress with “fast and proportional” measures.

In Asian Corporate News, Hong Kong’s airline reported, Cathay Pacific Airways Ltd., profits that made estimates made. The airline warned of an unsafe outlook for its freight unit due to global trade conflicts.

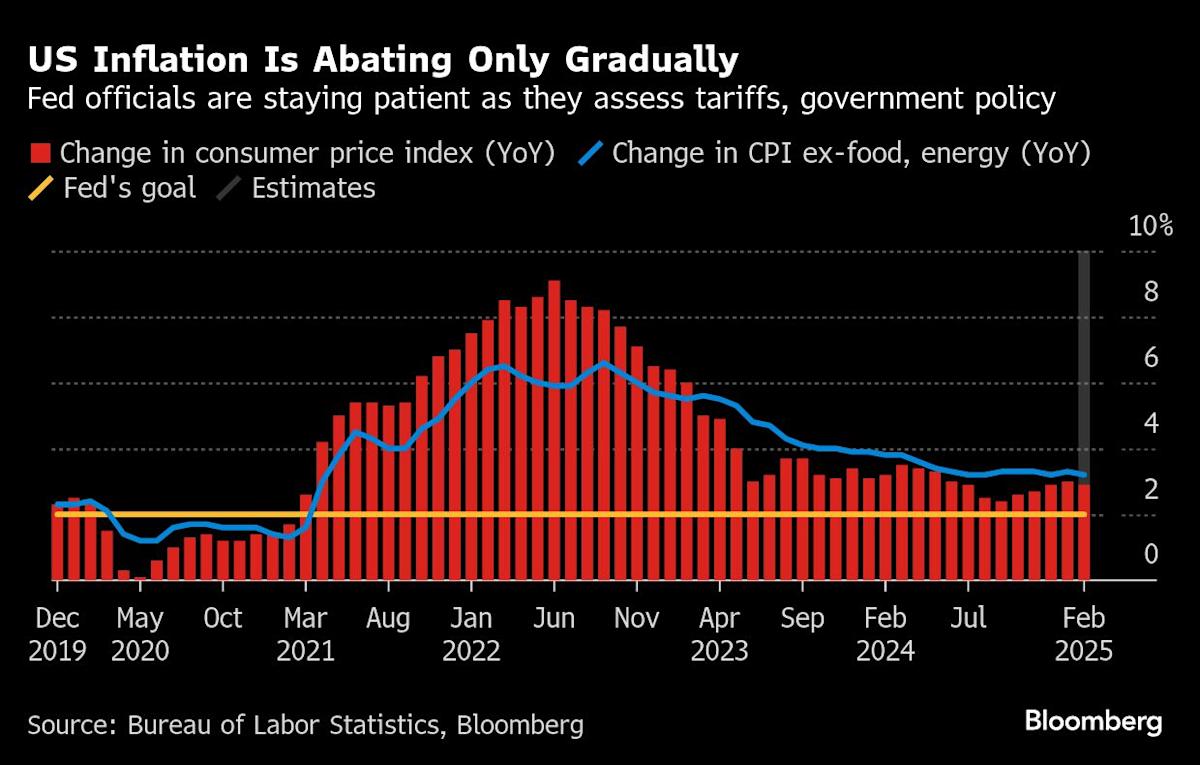

After reading the US consumer flation later on Wednesday, the economists predicted that it remained increased in January last month after a great increase in January, which increased that the progress in the taming of the prices is set. The consumer price index increased by 0.3% in February after winning 0.5% at the beginning of the year.

The markets “are aware of further signs of adhesive prices,” said Kyle Rodda, Senior Analyst at Capital.com in Melbourne. “Further signs of inflation set in the current level will raise concerns that the FED lacks scope to reduce interest rates if Trump’s economic policy causes a steep slowdown.”

Oil expanded a profit in raw materials when the United States lowered its forecast for a global oversupply. Gold kept his advance, supported by Haven demand.

Are tariffs more than the Fed for the US stock markets in 2025? Share your views in the latest MLIV pulse survey here.

Key events this week:

-

Canada tariff decision, Wednesday

-

US CPI, Wednesday

-

Industrial production of the euro zone, Thursday

-

US -PPI, first unemployed claims, Thursday

-

US University of Michigan Consumer mood, Friday

Some of the main movements in markets:

Shares

-

S&P 500 Futures climbed Tokyo by 0.2% at 2:29 a.m.

-

S&P/ASX 200 Futures fell by 1.3%

-

Japan’s Topix rose by 1.1%

-

Hong Kongs Hang Seng fell by 0.3%

-

The Shanghai Composite rose by 0.1%

-

Euro Stoxx 50 Futures rose by 1.1%

Currencies

-

The Bloomberg Dollar Spot Index rose by 0.2%

-

The euro fell 0.2% to USD 1.0896

-

The Japanese yen fell 0.3% to $ 148.24 per dollar

-

The offshore -yuan fell by 0.2% to $ 7,2392 per dollar

Cryptocurrencies

-

Bitcoin fell by 1.2% to $ 81,781.4

-

Ether fell by 3.4% to $ 1,869.91

Bindings

Were

This story was produced with the support of Bloomberg automation.

-with the help of Matthew Burgess, Chris Bourke and Abhishek Vishnoi.

Most read from Bloomberg Business Week

© 2025 Bloomberg LP