Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

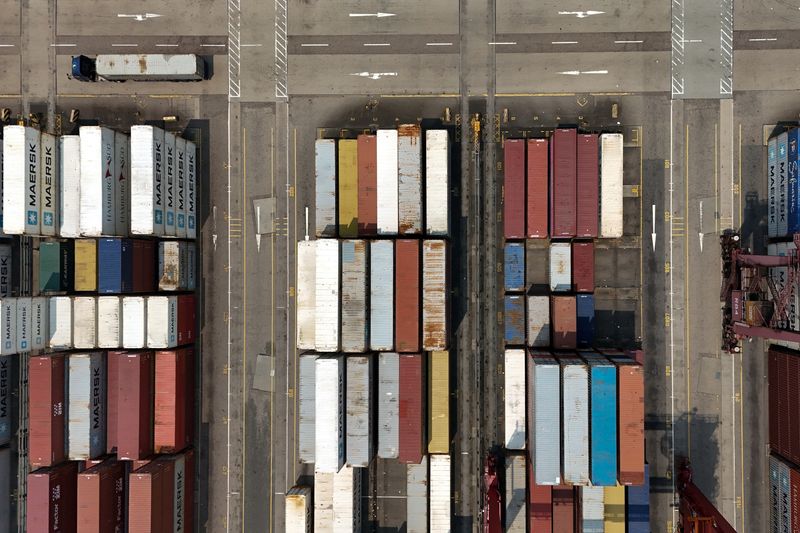

London (Reuters) -Cina announced additional tariffs of 34% for US goods on Friday and increased the use in a global trade war after President Donald Trumps extensive tariffs this week.

Growing fears before a recession browsed for a second day on Friday. The bank stocks were craters when investors were annoyed by growth and cost far more central cuts by the central bank, while the 10-year-old US state treasury lowered below 4%.

Comments:

Stephane Ekolo, market and equity strategist, tradition, London

“China comes out with an aggressive reaction to Trump’s tariffs. This is important and it is unlikely that it will be over, hence the negative market reactions. Investors are afraid of a Tit for Tat ‘trade war situation.”

Peter Andersen, founder of Andersen Capital Management, Boston

“The market is of course extremely surprised by China’s aggressive retaliation. I do not think that many investors expect such a sudden and large response to the percentages of the tariffs in the United States, so that the market that was already shaky was even more unusual.”

Kenneth Broux, Senior Stratege FX and Tariffs, Societe Generals, London

“It only feeds this risk aversion and growth disorders/recession in global trade.”

Christopher Wong, currency strategist, OCBC, Singapore

“Tit for the act brings memories of the episode of the 2018 trade war. The risk of slower global economic growth is expected to undermine the cyclical FX, including Aussie-Dollar, New Zealand dollar and Asia-Ex-Japan FX such as Korean Won and CNH.”

Samy Chaar, chief economist, Lombard Odier, Geneva

“It is still early to make a final assessment. There are two ways from here: there are those in which (Trump) shows openness to shops, and even if we have a hard start, with mutual tariffs and these answers from China show the willingness to speak and separate tariffs in the coming months.

“The other way is that he has no appetite to go on business, maintain the tariffs over a longer period of time, and that breaks the machine.

“I don’t think this (Chinese retribution on Friday) is a signal for one or the other. Everyone will bend their muscles, but it does not invalidate that he will give a deal at some point. But in addition we have to have signs that Trump makes comments that he expected to complete a deal.”

Eddie Kennedy, head of the tailor -made scope for discretion, Marlborough, London

“Others may have learned their lessons (from Trump’s last term). They defend themselves and say we can play the same game as they play and we are more able to negotiate.”