Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

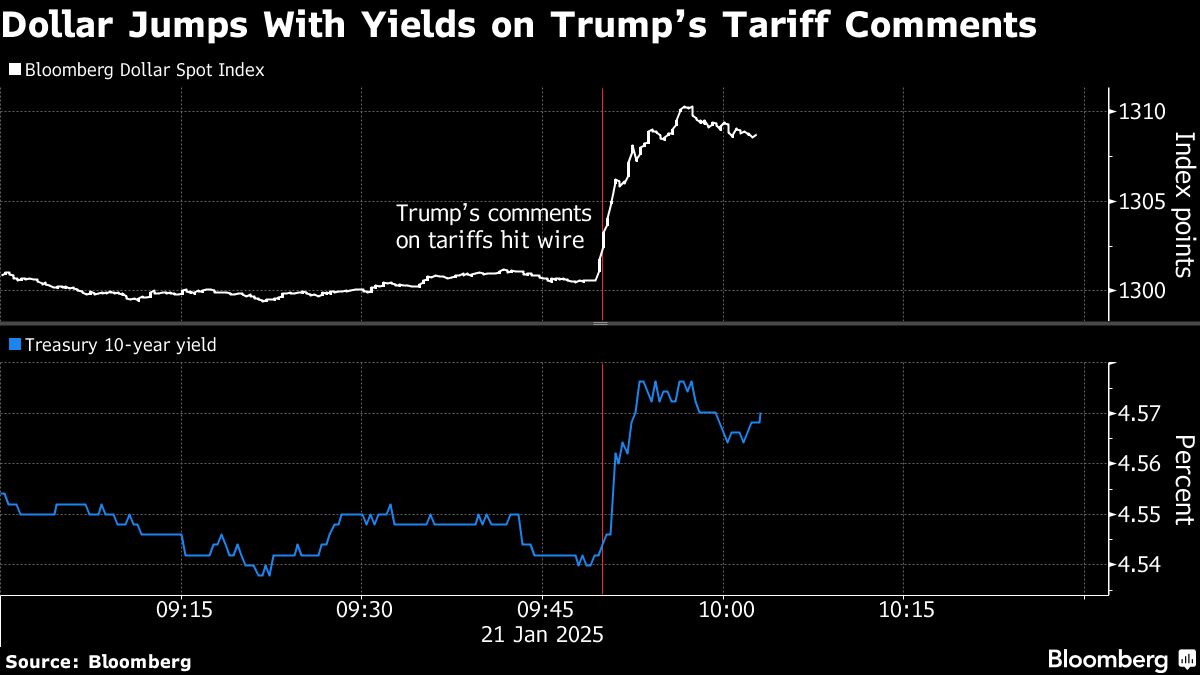

(Bloomberg) — The dollar rebounded after posting its biggest fall in 14 months on bets that U.S. President Donald Trump’s tariff plans would boost inflation and prevent further interest rate cuts by the Federal Reserve.

Most read by Bloomberg

Bloomberg’s dollar rose as much as 0.7% in Asia on Tuesday after trading slumped in New York as Trump said he may impose 25% tariffs on Mexico and Canada in February. The two countries’ currencies fell more than 1% against the greenback before weakening.

“If 25% tariffs are imposed on Mexico and Canada, higher tariffs on China will certainly soon follow,” said Rodrigo Catril, strategist at National Australia Bank Ltd. in Sydney. “The dollar has room to trade higher.”

The dollar had fallen immediately after Trump took office on bets that he would withhold immediate tariffs. The subsequent sudden reversal illustrates how nervous traders are reacting to news about tariffs and their impact on the global economy. Trump’s previous pledges, which included increasing duties on shipments from China to as much as 60%, have sent shockwaves through the $7.5 trillion-a-day foreign exchange market.

The risk of Trump’s high tariff policies and solid economic growth is expected to keep the Fed cautious about cutting interest rates and bolster the dollar’s resilience. Still, the future scope of Trump’s protectionist trade measures – and the timeline for their actual implementation – remains an open question that is being closely watched by traders.

Overnight indexed swaps signaled a 69% chance the Fed would cut interest rates more than once this year, up from 46% on Friday. SMBC Nikko Securities Inc. and Nomura Securities Co. both said U.S. yields could fall further.

Treasury bonds rallied as global cash trading resumed after the U.S. holiday on Monday, largely driven by the president’s decision to forgo imposing specific tariffs on China on his first day in office. The benchmark U.S. yield fell nearly 10 basis points to 4.53%.

“Markets were fixated on high tariff bazookas from day one,” said Shoki Omori, chief global desk strategist at Mizuho Securities. “The absence of this, particularly with respect to China, is leading to a recovery rally for government bonds.”

The offshore yuan fell as much as 0.4%, dragging down the risk-sensitive Australian and New Zealand dollars. The People’s Bank of China set the yuan reference rate at its highest level since November 8, signaling it is increasing support for the currency.