Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

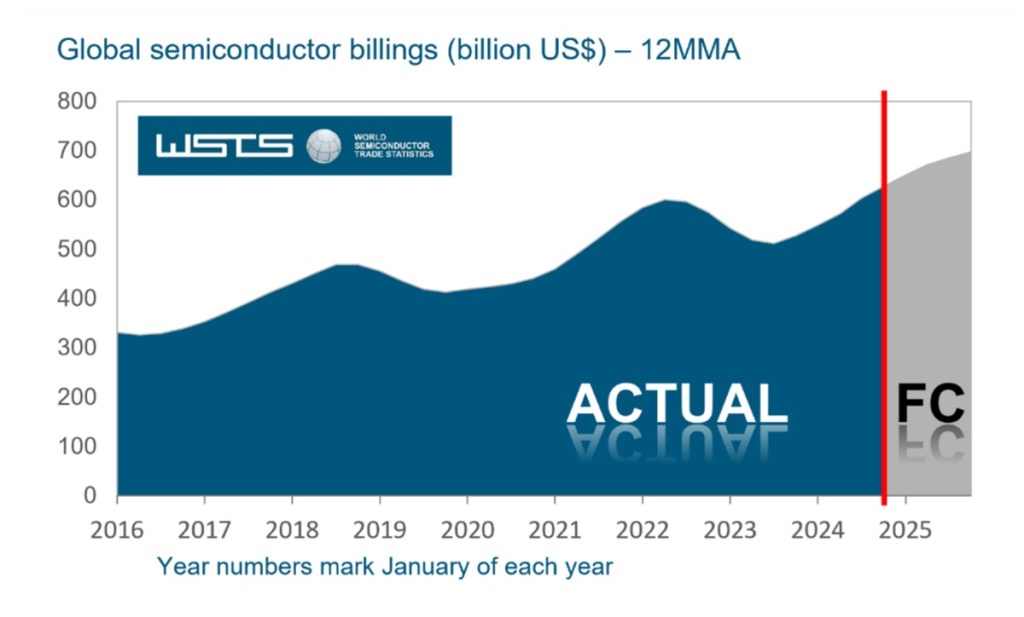

The turnover of the global semiconductor chip increased by 19.1% to 627.6 billion US Semiconductor Industry Association (IS).

The SIA said that the 2024 numbers made a new record and achieved a total of 526.8 billion US dollars in 2023 compared to a new record. The reason was of course the spectacular demand for AI processors and memory, said John Nuffer, CEO of the SIA, the lobby group of the chip industry, in an interview with Gamesbeat.

The actual growth of 19.1% was above the forecast of 13% that the SIA made, and the growth of 2024 compared to a contraction of 8.2% in 2023. Thanks to AI, this is enormous demand. And it is one reason why Nvidia is one of the most valuable companies in the world with an evaluation of 3.15 trillion dollars.

In 2025, CHIP’s turnover will probably achieve growth of 11.2% in an interview by 11.2%, said Greg Larocca, director of market research and economic policy at SIA. This is important for the economy, since chips are electronically and an essential part of the technology food chain.

The data come at an important time in national discourse as President Donald Trump has undertaken to place tariffs On semiconductor chips, not only from China, but also from our allied Taiwan. While he took measures against Mexico, China and Canada last weekend, he has not yet laid tariffs on Taiwan or chips. (The tariffs of Mexico and Canada were delayed by 30 days).

Jensen HuangCEO from Nvidia visited Trump in the White House last Friday to emphasize the importance of the semiconductor industry and the US leadership in the AI. Nvidia gets his chips from Taiwan. The Estimates of the consumer technology association These tariffs could make game consoles 40% more expensive for US consumers, with a price increase of 26% for smartphones and 46% price increase for laptops.

The SIA was also a great advocate of the chips & science act, a non -partisan law that is intended 52 billion US dollars To reconstruction the chip production in the US Intel, it was found in Intel that it has already received 2 billion US dollars for its US chip factories. It remains to be seen whether the new administration will continue to support the law because the lawyers are demanding more money.

“After all the plants that are currently being built, started and started, the United States is at the end of around 14% or so. It takes time. It is an absolutely massive industry. And moving the needle from 10% to 14% is indeed a remarkably good number. It is a sign of how difficult it is to move. And of course it is the same for Europe, ”said Duncan Stewart, a chip manager at Deloitte report this week.

As far as the chip figures are concerned, sales with $ 170.9 billion in the fourth quarter were 17.1% more than in the fourth quarter of 2023 and 3.0% more of 1.2% compared to November 2024.

The monthly sales are compiled by the WSTS organization (Semiconductor Trade Statistics) and exhibit a sliding three-month average. SIA makes 99% of the US semiconductor industry through income and almost two thirds of non-US chip companies.

“The global semiconductor market recorded its highest sales year in 2024 and for the first time led annual sales of $ 600 billion, and double-digit market growth is projected for 2025,” said Nuffer. “Halfcoats enable practically all modern technologies-communication, communication, defense applications, AI, advanced transport and countless other and long-term industry prospects are incredibly strong.”

Regionally, annual sales in America (44.8%), China (18.3%) and in Asian-Pacific space/all others (12.5%), but in Japan (-0.4%) and in Europe (-8.1%). Sales from month to month in December in America (3.2%) rose in the Asian-Pacific area/all other (-1.4%), China (-3.8%), Japan (– 4.7%) and Europe (-sunk. 6.4%).

“With the global increase in semiconductor sales, America will triple its domestic chip production capacity by 2032 and bring our country into a strong position to strengthen its supply chains and satisfy the increasing global demand,” said Nuffer. “In order to keep America at the top in chip technology, the managers in Washington should advance guidelines that promote the production and innovation of the semiconductors, strengthen the high-tech workforce and restore US trade management.”

Several semiconductor product segments achieved in 2024. In 2024, sales of logic products were 212.6 billion dollars and was therefore the largest product category after sales. With regard to sales, the memory products took second place and rose by 78.9% in 2024 to a total of 165.1 billion dollars. DRAM products, a subgroup of the memory, recorded an increase in sales of 82.6%, the greatest percentage growth of a product category in 2024.

Nuffer said that the logic (including processors), memory and analog segments are often on different trajectories, since there are many different types of semiconductors that serve all electronic industries. Logic and memory were driven by the demand for AI servers in data centers and KI PCs in offices and houses. But sometimes there is a good year for logic and a bad year for memory, depending on the capacity.

Larocca said the SIA does not yet classify AI chips separately, but a large part of the AI technology is embedded in computer systems with logic chips. This category rose by 81%in 2024, he said.

“It is an amazing growth rate that we have never seen before,” said Nuffer. “It is very fast growth across the board.”

But he noticed that the industry can be “incredibly volatile” in terms of oscillations in areas such as memory chips.

In an understatement, Nuffer said that the prospects for a trade war were “problematic”.

“Our supply chains are deep on the global trade. The operation of these supply chains is everything for us. On the other hand, about three quarters of our customers are overseas. So the global trade is only a large part of our success, ”said Nuffer.

Nuffer said he did not want to go into hypothetics about the cold. He noticed that the details are important, how what happens to a chip that sends back and forth before it occurs in an electronics product bought in the USA. It also depends on which countries are taken with the tariffs and retaliation measures.

With regard to the training of politicians, he said that there is still a certain area to understand how the supply chains work.

“We consider measures that increase the manufacturing costs in the United States as problematic when our companies made very large, very essential obligations for the production of more (in the USA) and how this administration has made more priority for the production of more More production here, ”said Nuffer. “We really believe that there is a chance to incorporate a comprehensive strategy that includes a number of things, e.g. Commercial leadership all over the world because we depend on global trade as a industry. “

Nuffer said the Chips & Science Act was incredibly important for the industry and the country.

“But standing alone is not a strategy. It is a piece of a larger strategy. And the larger strategy has immigration policy, which ensures that the talent that we train here remains here, and a wider strategy of the workforce to train the talent here in Germany, ”he said.

Funding of applied science and basic science is also crucial to keep the United States competitive, he said. Some politicians have raised objections to give companies money to build chip factories. But Nuffer noticed that other countries used subsidies to get the production out of the USA, and now we are back.

“That’s why we drove into the ditch has been over the years. Our federal government was not involved. Other governments all over the world had led circles around us and were probably confused that we were stuck, and as a result, our production has taken back dramatically in the past 30 years, ”he said. “The chips act has turned over, and if the incentives somehow rejuvenate again, it will also rejuvenate our production footprint. That is just the reality. “

Larocca said that the inequality in incentives led to 25% to 50% more expensive to build and operate a factory in the United States without US incentives being available compared to other countries. There are also reasons such as the resilience of the supply chain and national security to keep chip production ashore, said Nuffer. He found that the incentives of the Chips & Science Act generated almost 500 billion US dollars in the USA by 2032 in the United States. The chip manufacturing capacity in the United States could triple. This is a higher growth rate than somewhere else in the world, said Nuffer.

The chip sales were disrupted during the pandemic. While the demand for PCs compete when people worked from home, the factories were interrupted and the supply chain could not work during covid. The industry recorded a decline from the second half of 2022, and this led to a decline in sales of 8.2% in 2023, said the SIA. The growth of the memory chip at 2024 reached 70% compared to 2023.

On the whole, the Chi industry moves from oversupply to deficiency in 18 months. One reason for this is that it costs billions of dollars and a considerable time for building a brand new factory. If demand changes, it is difficult to achieve capacity faster, and prices change as results prices.